41+ debt to income ratio mortgage calculator

In the United States normally a DTI of 13 33 or. To get the back-end ratio add up your other debts along with your housing expenses.

Debt To Income Ratio Calculator The Spreadsheet Page

Web Debt Ratio Calculator add to your website or run on ours.

. Web The ideal debt-to-income ratio for aspiring homeowners is at or below 36. Add up your monthly debt payments rentmortgage payments student loans auto loans and your monthly minimum credit. Free Shipping on Qualified Orders.

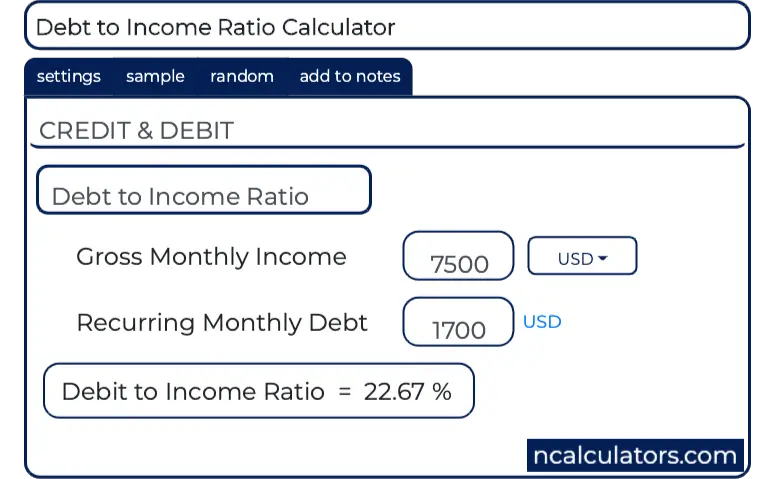

Web Compare up-to-date mortgage rates and find one thats right for you. Total monthly debt payments divided by total monthly gross income before taxes and other deductions. Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments.

Web To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan payments car payments minimum. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall. A 20 down payment is ideal to lower your monthly.

Borrowers with low debt-to. If you spend more than 41 of your income on debt payments each month that makes you a high-risk candidate for a loan. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio.

Use Our Online Mortgage Calculators to Estimate Your Home Loan Payments Today. Web As a general rule your debt-to-income ratio should remain below 36 with no more than 28 of your income going toward mortgage-related expenses. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend. For most lenders the cutoff is around 41. Web Your front-end or household ratio would be 1800 7000 026 or 26.

Here Are 7 Little-Known But Brilliant Hacks To Help Pay Down Credit Card Debt. Your debt to income ratio or debt ratio is the percentage of income that goes to pay housing and debts - and it. Ad Getting Out Of Debt May Be Easier Than You Think.

Of course the lower your debt-to-income ratio the better. Ad Shop Devices Apparel Books Music More. Web The debt-to-income formula is simple.

Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web Debt-to-Income Ratio Calculator.

In this formula total monthly debt. Average rates data provided by Icanbuy LLC. Web Your debt-to-income ratio matters when buying a house.

Web Debt-To-Income Ratio - DTI. Were not including additional liabilities in estimating the. 36 DTI or lower.

Web The amount of money you spend upfront to purchase a home. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web Heres how the debt-to-income ratio is calculated.

Explore These Tips Tricks Apps Now. Web Debt-to-income ratio is what lenders use to determine if you are eligible for a loan. Ad See what your estimated monthly payment would be with the VA Loan.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Heres how lenders typically view DTI. Ratios falling in this range often show lenders that you have a lot of debt and may not be ready to take on a mortgage loan.

Ad How Much Interest Can You Save By Increasing Your Mortgage Payment. Most home loans require a down payment of at least 3. If you have too much debt relative to your income you wont get approved for a new loan.

Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. Use Our Online Mortgage Calculators to Estimate Your Home Loan Payments Today. Then multiply that number.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. This includes cumulative debt payments so think credit card. For example the VA and FHA loans allow for DTIs of up to 41.

Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator. However requirements may vary slightly depending on your lender and the type of loan youre applying for. Web 43 50.

Web How to calculate your debt-to-income ratio. Web While DTI ratios are widely used as technical tools by lenders they can also be used to evaluate personal financial health.

Debt To Income Dti Credit Com

Debt To Income Ratio Calculator Officetemplates Net

Debt To Income Dti Ratio Calculator Money

Debt To Income Ratio Calculator Ramsey

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

Debt To Income Dti Ratio Calculator 2023 Casaplorer

Calculate Your Grade On Suze S How Am I Doing Financially Show Pdf

Debt To Income Ratio Calculator Lowermybills

Mortgage Calculator Financial Philosophies

Calculating Your Debt To Income Ratio How To Guide

Debt To Income Ratio Calculator The Spreadsheet Page

Debt Income Ratio Calculator Front End Back End Dti Calculator For Mortgage Qualification

Debt To Income Ratio Calculator

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

How To Calculate Your Debt To Income Ratio For A Mortgage

Mortgage Calculating Debt To Income Ratio Using Property Income Debt

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator